Trends, Drivers & Outlook

1. Robust Growth Forecasts Across Institutions

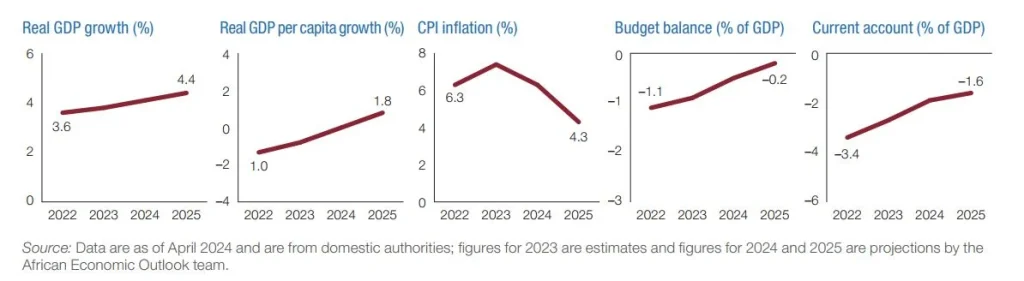

- African Development Bank (AfDB) projects GDP growth of around 4.4% in 2025, rising from 4.1% in 2024, thanks to strong domestic gas output and higher commodity prices (fitchsolutions.com, afdb.org).

- World Bank sees Cameroon’s medium-term real GDP growing ~4.5% annually from 2025 to 2027, supported by climbing energy supply and public investment (worldbank.org).

- Fitch Solutions forecasts GDP up to 4.2% in 2025, driven by private consumption and cocoa exports.

- IMF Staff Report expects growth near 4.3% in 2025, with inflation easing toward CEMAC targets (elibrary.imf.org).

- The Bank of Central African States (BEAC) projects regional CEMAC growth of 3.2% in 2025, up from 2.7% in 2024 (businessincameroon.com).

Summary: Most projections cluster between 4.0% and 4.5% — a healthy rebound from mid‑3% growth in 2023–24.

2. Key Drivers of Growth 🔑

a) Domestic Demand & Consumption

- Private consumption is expected to grow 4.2% in 2025 (up from 4.0%), fueled by improved purchasing power and higher cocoa incomes.

- Slower inflation (forecast around 4%) and stable fuel prices amid election considerations also support household spending.

b) Infrastructure and Fixed Investment

- Major public infrastructure—Nachtigal dam, Kribi port expansion, and Ngovayang iron projects—are expected to boost fixed investment by 6.0%, contributing 1.3 pp to GDP.

- Additional infrastructure funding includes EU support (€91m loan) and World Bank backing, targeting energy, roads, railways, and social safety nets (apnews.com).

c) Commodity Exports

- Cocoa output is projected to rise around 6.7%, supported by high world prices, benefiting agriculture-employed households .

- By contrast, hydrocarbons face decline: oil & gas production down 1.7%; net hydrocarbon exports down ~7.5%.

- However, the Dangote refinery in neighboring Nigeria began exporting petrol to Cameroon, potentially easing energy imports and stabilizing domestic fuel costs (reuters.com).

d) Fiscal Reforms & Tax Compliance

- Cameroon continues implementing G20/OECD BEPS reforms, including global minimum corporate tax and enhanced transfer pricing, expected to boost revenue by up to XAF 15–20 bn annually (mlz.co.il).

- The World Bank urges stronger forestry governance, broader tax bases, and fiscal decentralization—aims echoed by IMF supportive measures .

3. Monetary & Fiscal Indicators

- Inflation: Expected to decline to around 4.3–5.9% in 2025, moving closer to the CEMAC threshold of 3%, aided by tighter BEAC monetary policy (elibrary.imf.org).

- Budget Deficit: Forecast to narrow to 0.2–0.8% of GDP, reflecting improved revenues and disciplined spending despite election-cycle expenses.

- Current Account: Expected to modestly improve (approx –1.6% to –2.8% of GDP) as exports strengthen.

- Public Debt: Projected to stabilize or gradually decline (e.g., ~39% of GDP in 2025), supported by reforms .

Fitch affirms Cameroon’s ‘B’ credit rating with a Negative Outlook, citing political succession risks and structural governance weaknesses.

4. Risks & Challenges

- Political volatility surrounding the October 5, 2025 election, with President Biya’s advanced age (92) raising concerns, may destabilize investor sentiment.

- Security threats (e.g., Anglophone & Boko Haram conflict zones) pose risks to agriculture, infrastructure, and investor confidence .

- External shocks, including commodity price drops, global policy shifts, and regional instability, remain threats .

- Governance: Weak public financial systems and corruption could undercut infrastructure gains—prompting donor conditionality .

- Climate risks: Long-term threats to GDP via environmental stress and inadequate climate finance frameworks .

5. Human & Social Investments

- Social protection programs: World Bank supported projects, allocating XAF 166 bn (~$35m additional), aim to assist 100,000+ vulnerable households.

- Energy access ambitions: Plans for Cameroon to become a Central African electricity hub are supported by IMF, World Bank, and AfDB—backing Nachtigal dam and cross-border grids (theguardianpostcameroon.com).

- Climate finance integration: Cameroon working with IMF, World Bank, and partners to embed climate resilience in its planning (en.wikipedia.org).

Outlook & Policy Implications

Cameroon enters 2025 with renewed growth momentum, anchored in consumption, infrastructure, and commodity resilience. But sustainable progress hinges on:

- Maintaining fiscal discipline, expanding tax bases, and reducing corruption to finance public goods.

- Ensuring political and security stability, especially in the lead-up to elections.

- Strengthening climate adaptation and finance to safeguard agricultural and environmental stability.

- Leveraging regional energy integration, such as growing links with Nigeria’s Dangote refinery.

If Cameroon successfully implements structural reforms—especially in public finance, energy, tax compliance, and climate resilience—it could lift growth toward the 4–4.5% range until 2027, improve debt sustainability, and enhance living standards.

Yet uncertainty remains: electoral politics, conflict zones, governance issues, and external headwinds could derail progress. The challenge will be converting short-term economic momentum into inclusive, long-term prosperity beyond election cycles.

What to Monitor Next

- IMF Executive Board’s approval of ongoing financing reviews and new disbursements.

- Infrastructure milestones, especially the Nachtigal dam output and Kribi phase II.

- Tax reform rollouts, including BEPS compliance and forestry sector revenue efforts.

- Fuel price trends, potentially affected by Dangote–Cameroon energy ties.

- Election-related fiscal transparency, and any signs of fiscal slippage or unrest.

In summary, Cameroon in 2025 is poised for growth—but turning forecasts into lasting dividends depends on political, fiscal, and structural reform execution amid a complex domestic and global landscape.